5 Inventory Analysis Methods Explained

Inventory analysis is the technique used to determine the ideal level of inventory for a company to avoid stock outs or over stocking situations. Inventory analysis is particularly important for wholesalers of durable goods as market demands can fluctuate and vary greatly over time. Knowing your inventory, maintaining efficient processes for managing stock levels, and monitoring and acting on changes in customer demand are all essential for effective inventory management.

Managing inventory is of vital importance to wholesalers, and there are a number of common problems to navigate when optimizing inventory levels. Inventory control can easily become out of balance when warehouse locations have too much excess stock or obsolete stock on hand, resulting in a tightening of working capital. Inventory control and inventory optimization can be likened to a high wire balancing act while being blindfolded. Most companies do not have the right processes or technology in place to help them forecast into the future with confidence which can be very dangerous to a companies profitability and growth.

3 costly inventory analysis mistakes made by distributors

It is imperative to consider – and work to avoid – making the greatest and costliest mistakes in supply chain management. Below are three costly inventory analysis problems facing wholesale distributors today:

- Not dealing with excess stock. Efficient monitoring of inventory can ensure that due priority is given to the more profitable items in your inventory with high turnover, and separate out those which may be numerous but less profitable or slower moving items. Knowing your item level inventory turnover ratios is vital when analyzing inventory stock health; for example, do you have enough of your A-classified goods in stock to meet supply – and do you need to keep a C-classified product in stock at all or are they just tying up working capital? Additionally, not dealing with excess stock in a timely manner can lead to inventory obsolescence, which can be even more costly to business operations.

- Poor handling of inventory obsolescence. Any wholesale business carries certain unpredictability, and there will be occasions where unwanted or obsolete stock is retained in inventory, perhaps due to over-ordering or unanticipated lack of customer demand. This stock is likely not sellable for a profit but it also needs to be liquidated from inventory as it can lead to even larger financial losses for a company over time. Most items in a warehouse that have not had an inventory turnover within a 12 month period can be classified as obsolete and should be systematically removed from inventory to offset unnecessary carrying costs.

- Not analyzing inventory seasonality. An important element of ensuring supply meets demand is awareness of how customer behavior for a product is affected by seasonal changes. This is a way of accounting for, and preparing for, higher and lower periods of demand, which may involve altering procurement rates at different times of the year, or storing extra products in inventory to be on hand during peak seasons of the year. For wholesale distributors, carefully managing safety stock levels is the best way to manage and account for demand volatility in the supply chain.

Common inventory analysis methods

There are a few different methods used by inventory managers to analyze their stock levels. Inventory analysis methods commonly involve either considering the overall inventory turnover (the cost of goods sold divided by the average inventory), or using the average daily cost of goods sold to determine the total number of days’ stock remaining in inventory.

Different inventory analysis methods, techniques and best practices include:

- ABC analysis is a means of categorizing stock, whereby an inventory classification system is used to set the most valuable stock at A (‘the critical few’), and the least valuable as C (‘the trivial many’). A, B and C classifications are assigned to items which have a high, medium and low annual consumption value. Putting class A items closer to your shipping and receiving area in your warehouse will save time and labor costs when processing customer orders. Inventory optimization software is a commonly used tool to help identify what items should be classified by which category.

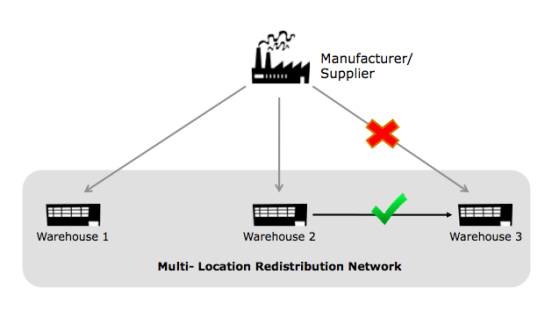

- Inventory redistribution is the process by which stock is automatically transferred between stocking locations such as different warehouses where demand maybe be higher for certain items in a certain area as compared to other regions. Redistribution is critical for businesses looking to avoid purchasing more stock levels for items that are already heavily stocked within the company’s network of storage locations. This method is ideal for fast-moving industries or industries with high seasonality, as items are not as dependent on supplier lead-times. Illustrated in the example below, a wholesale distributor with multiple warehouse locations can redistribute excess stock levels from Warehouse 2 to Warehouse 3 at a fraction of the cost compared to purchasing new stock from the manufacturer or supplier. Demand is still met and additional working capital costs were avoided.

- First In, First Out (FIFO) is the method where the oldest inventory items are sold first and the newest products are sold last. The oldest cost of an item in inventory will be removed first when one of those items is sold. This oldest cost will then be reported on the income statement as part of the cost of goods sold. FIFO also means that the more recent costs of an item will remain in the inventory account and will be reported on the balance sheet. This is the most common method used today by distributors.

- Last In, First Out (LIFO) is the method used when the most recently produced items are given preference and are sold more quickly. LIFO is a popular account inventory management method for manufacturers or distributors that deal with frequent fluctuations in the cost of items purchased. In this case the more expensive items were used first. The use of LIFO will result in less taxable income and less income tax payments than the FIFO method if cost of goods sold go up over time. Over a long period of time, or when costs increase dramatically, the lower income tax payments will be significant.

- Average cost is less often used, as this method treats older and newer stock the same, and simply takes a mean average of the cost of all stock irrespective of its current market value. This method is a less reliable way to ensure your cost of goods sold and the inventory values on the balance sheet are accurately reported.

Which method is the best for Wholesale Distributors?

For wholesale distributors of durable goods, if the cost of materials or finished goods from suppliers tends to increase over time (and what doesn’t cost more over time?) using LIFO will typically result in lower taxable income compared to the FIFO method.

Distributors should keep in mind that to maintain a relatively strong balance sheet, which helps a company qualify for loans, satisfy investor expectations, or to impress industry analysts, the FIFO method may be the better option as working capital tends to look stronger.

For those simply looking for a blended average associated to costs, then the Average Cost method is the easier route to take. Lastly, for distributors that are looking to avoid stretching cash flow or prefer to avoid rush ordering supply, inventory redistribution is ideal for off setting the procurement of larger quantities of product that run the risk of obsolesces over time. Since most suppliers require larger quantity bulk orders to drive volume price discounts, redistribution can be a far less expensive option.